As we head into the middle of August 2023, it’s essential to reflect on the recent developments in the freight and trucking industry. This article provides an overall overview of the market trends, carrier dynamics, and the impact of external factors on the industry.

Carrier Dynamics

Last week, the net change in carrier population was a decrease of 80 carriers. This marks the second lowest loss since April 2023. Involuntary revocations are at their lowest since April 2023, while new authorities are on the rise. Voluntary revocations and reinstatements have both seen an uptick.

General Freight Market Insights

Outbound tender volumes remain elevated, indicating a robust demand for freight services.

Tender rejections are currently at 3.38%, meaning only a small portion of the total freight volume is being pushed to the spot market. Weekly data reveals a 0.24% increase in volumes and a 1.2% rise in rejections.

Spot vs. Contract Carriers

Contract carriers are currently earning an average of 74 cents more per mile than spot carriers. This disparity reduces the incentive for contract carriers to reject freight in favor of better alternatives.

Diesel Prices

According to AAA, diesel prices have risen $3.843 from a month ago to $4.269 as of August 11, 2023. This eats into carrier profits. However, rates my rise to help ease carrier pain.

Flatbeds

Spot volumes for flatbeds have seen a slight increase, but they remain below the five-year average. Rates for flatbeds have held steady at around $2.40 per mile for the past three weeks, closely aligning with the five-year average.

Reefers

Reefer spot volumes have experienced a notable jump, aligning with the five-year pattern. Rates for reefers have increased from approximately $2.27 to around $2.45, partly influenced by rising diesel fuel surcharges.

Dry Van

Dry Van spot volumes are gradually increasing, following the five-year average. Rates for drive-ins have seen a jump from around $1.80 per mile to approximately $1.85-$1.90.

Impact of Big Trucking Companies Failures

The recent bankruptcy of Yellow, a major less-than-truckload carrier, has left a significant void in the market. With Yellow previously handling over 50,000 loads daily and employing 30,000 individuals, one might expect a substantial market impact. However, the current overcapacity has allowed companies like Old Dominion, XPO, ArcBest, Forward Air, FedEx, and UPS to absorb Yellow’s volume seamlessly.

CloudTrucks, a freightech company based in San Francisco, recently laid off 40% of their staff. This is following recent layoffs by Uber Freight, Convoy, and several other big freightech trucking companies and brokers.

Looking Ahead

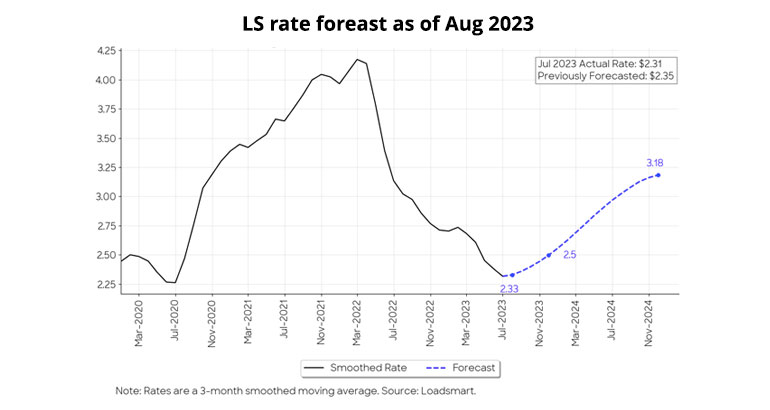

Loadsmart, one of the largest freight brokers in America, recently posted their predictions for the trucking market.

The freight and trucking industry is in a state of flux, with various factors influencing its trajectory. While there are challenges ahead, there’s always hope for positive change. Staying informed and finding what your trucking niche is key to staying ahead in the industry.

Contact Us for all kind of Trucking Authority & Permit Services, and stay tuned for more updates, and here’s to a brighter future for the industry.