The trucking industry is currently navigating through a challenging and unpredictable environment. This week, we delve into the freight market’s current state and what we can expect in the coming week.

Trucking Spot Market

The outbound tender volumes and outbound tender rejections are key indicators of the freight market’s health. Following the July 4th holiday, the market experienced a significant decrease in volumes, which is a typical trend observed annually. However, as of July 13th, volumes have started to pick up again, indicating a return to normalcy.

Tender rejections, which represent the amount of freight that contract carriers push to the spot market, have also seen a similar trend. After a dip around July 4th, tender rejections have started to rise again. However, a slight decrease from July 12th to 13th is a cause for concern. Currently, rejection rates stand at 3.16%, indicating that only a small percentage of loads are likely ending up on the spot market.

The National Truckload Index for line haul only (NTIL), which represents the spot market rate without fuel surcharge, currently stands at around $1.69 per mile. This index has decreased by almost 19% since the beginning of the year. Meanwhile, contract rates are currently paying on average 75 cents per mile more than the spot market, although this gap is gradually decreasing.

Diesel Prices

The nation’s average diesel prices have been steady, currently standing at $3.85 per gallon according to AAA. This increase is affecting various markets, including California, Virginia, Florida, Georgia, Texas, and South Carolina.

Truckload Markets

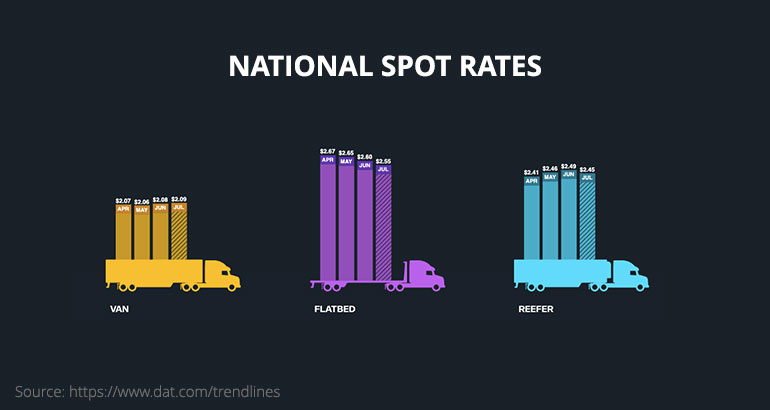

Flatbed Carriers

Looking at the flatbed market, volumes have decreased significantly, dropping to the lowest level since the beginning of the year. Surprisingly, flatbed spot rates have experienced a small increase over the last week, indicating that capacity also left the market last week.

Reefer Carriers

The reefer market, on the other hand, saw a decrease in both volumes and spot rates. The general freight volumes remained relatively flat, with some areas experiencing increases.

Dry Van Carriers

In the dry van market, volumes decreased, leading to a drop in rates. However, there are areas of opportunity in Southern California, parts of the Midwest, and Texas, where tender rejections are high, indicating more volume ending up on the spot market.

Is it a good time to start a trucking company in 2023?

Several of the biggest and most successful trucking companies in America have started in recessionary times. Starting small now can help you learn the industry and prepare you for big growth when the good times come. After going through the last few market declines in 2015 and 2019, we have found that it doesn’t matter when you start. It’s a trucking company’s management, organization, and preparation that determines how well it does. If you need help starting your trucking company, we can help plan your journey. Whether you want to start now or later, contact us.

In this unpredictable market, it is crucial to be prepared for the worst-case scenario while hoping for the best. Every day matters, and it is essential to negotiate rates strategically and be aware of where you are going. Despite the challenges, the key is to keep going and not give up. As Martin Luther King Jr once said,

“If you can’t run, then walk. If you can’t walk, then crawl. But whatever you do, you have to keep moving forward”