One of the most important aspects in running a successful trucking business is not just about hitting the road; it’s also about keeping your finances in order. While the freedom and adventure that come with starting your own trucking company are exciting, many truckers forget that the administrative side of things can be quite daunting, especially if you’re not familiar with truckers bookkeeping. So, how do you manage the financial aspects of your trucking business effectively? Here’s a comprehensive guide to help you navigate the world of bookkeeping for your trucking venture.

Knowing your CPM helps you set realistic pricing for your services and identifies areas where you can cut costs to increase profitability. Before you accept a load, you can calculate whether or not it will be profitable using your CPM.

Why Bookkeeping Matters

Bookkeeping is important for any business you start, and in the trucking industry, it’s no different. Proper bookkeeping helps ensure that you know where your hard earned money is going. It also allows you to visualize expenses and make financial plans to grow your business in the future and stay prepared for emergencies. Truckers bookkeeping doesn’t have to be complicated. You can use the help of accounting softwares to help you book keep on your own or you can hire truckers bookkeeping services to help you in this endeavor. It doesn’t matter whether you’re an owner operator or own a fleet, bookkeeping for truckers is essential to start and run a successful trucking company.Choosing the Right Accounting System

Before diving into the actual work, you need to select an accounting system that suits your business needs. You have two primary options:- Cash Basis Accounting: In this system, you record revenue and expenses as they occur.

- Accrual Accounting: This is a more complex system where you record revenue and expenses as they are earned or incurred, regardless of when the money changes hands.

Keeping Your Books in Check

Once you’ve chosen an accounting system, the next step is to maintain your financial records. You can use trucking management software or specialized accounting software to track various financial documents like profit and loss statements, tax estimates, and expense ledgers. Keeping these records updated is crucial for understanding your business’s financial health. An important part of bookkeeping is knowing what your fixed and variable expenses are: Fixed Expenses are expenses that remain constant regardless of your sales or business activity. No matter how much business you do or how many miles you drive, these expenses will be the same amount.Keep track of fixed expenses

Such as,- Equipment Loan Payments for Semi Trucks or Trailers

- Insurance Payments

- Truck Parking Rent

Keep track of variable expenses

Such as,- Fuel Costs

- Estimated Taxes

- Maintenance Costs

- Repair Costs

- Finance and Factoring Costs

- Driver Pay(or your own pay if you’re an owner operator)

Tracking Your Finances

In today’s fast-paced world, it’s all too easy to swipe a business credit card or fuel card without giving it a second thought. However, this convenience can lead to a slippery slope of uncontrolled spending. That’s where bookkeeping comes in handy. Bookkeeping helps organize your expenses and income in one place, so you’re able to plan for expenses and know if you’re a profitable trucking company. Knowing your monthly profit and finances helps you understand if you’re meeting your financial goals.Saving for Emergencies, New Equipment, and Taxes

Life is full of surprises, and in the trucking business, these surprises can be costly. Keeping track of your finances can help you plan to set aside money to protect you against unexpected events. You should save money to help you in the following events:- Unexpected Breakdowns or Repairs

- Insurance Renewal Down Payments

- Buying New Semi Trucks and Trailers

- Paying Income Taxes

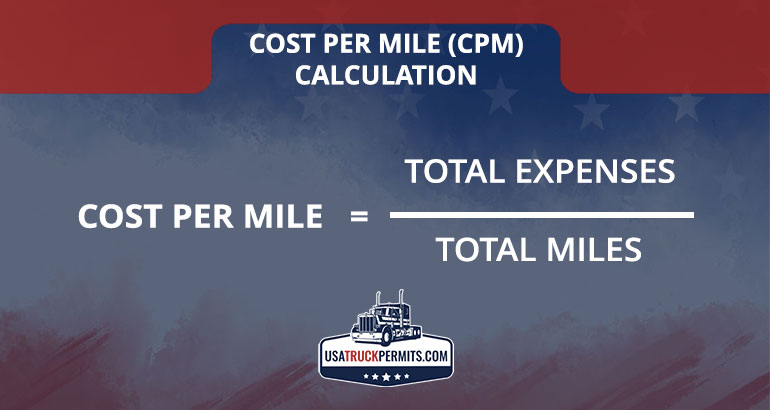

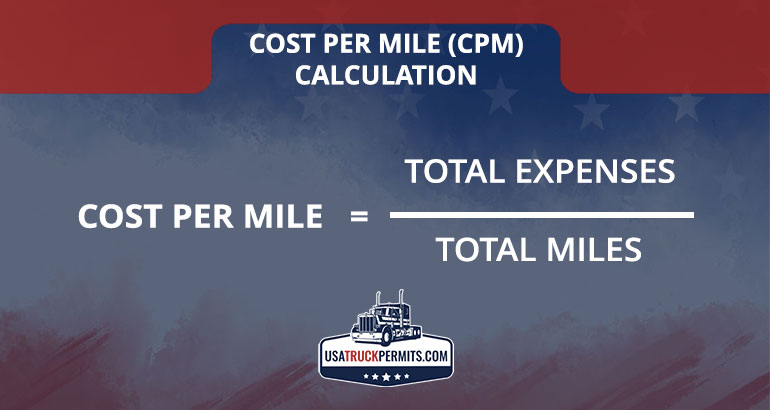

Calculating Cost Per Mile (CPM)

Understanding your Cost Per Mile (CPM) is like knowing the fuel efficiency of your truck—it’s vital for long-term success. CPM includes all the costs associated with running your truck, from fuel and maintenance to insurance and permits. To calculate it, simply divide your total expenses by the total miles driven. This gives you a clear picture of how much it costs to operate your truck for every mile you drive.

Knowing your CPM helps you set realistic pricing for your services and identifies areas where you can cut costs to increase profitability. Before you accept a load, you can calculate whether or not it will be profitable using your CPM.